Analysts say EA buyout "doesn't add up," expect the company to double down on live services and sports at expense of "new ideas and innovation" with layoffs looking inevitable

"Short term they may look to sell off non-crucial assets and smaller IP"

Weekly digests, tales from the communities you love, and more

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Every Friday

GamesRadar+

Your weekly update on everything you could ever want to know about the games you already love, games we know you're going to love in the near future, and tales from the communities that surround them.

Every Thursday

GTA 6 O'clock

Our special GTA 6 newsletter, with breaking news, insider info, and rumor analysis from the award-winning GTA 6 O'clock experts.

Every Friday

Knowledge

From the creators of Edge: A weekly videogame industry newsletter with analysis from expert writers, guidance from professionals, and insight into what's on the horizon.

Every Thursday

The Setup

Hardware nerds unite, sign up to our free tech newsletter for a weekly digest of the hottest new tech, the latest gadgets on the test bench, and much more.

Every Wednesday

Switch 2 Spotlight

Sign up to our new Switch 2 newsletter, where we bring you the latest talking points on Nintendo's new console each week, bring you up to date on the news, and recommend what games to play.

Every Saturday

The Watchlist

Subscribe for a weekly digest of the movie and TV news that matters, direct to your inbox. From first-look trailers, interviews, reviews and explainers, we've got you covered.

Once a month

SFX

Get sneak previews, exclusive competitions and details of special events each month!

Sizing up EA's unprecedented $55 billion leveraged buyout, multiple analysts reckon the deal could result in termination or downsizing for some employees at the company and for many EA games or franchises that plenty of people enjoy, even if operating privately rather than publicly could give EA some protection from other industry hazards.

After this buyout, veteran industry analyst Serkan Toto of Kantan Games, speaking with GamesRadar+, expects "there will be an even stronger focus on evergreen IPs, blockbusters (fewer but potentially bigger games) and live services - at the expense of riskier projects, new ideas and innovation."

Likewise, David Cole, CEO of market research and consulting firm DFC Intelligence, thinks "EA will double down on live services and sports games that have a fairly predictable revenue stream and profit margin. Long term they may look to do more strategic moves that do not pay off immediately but position them for future growth. Short term they may look to sell off non-crucial assets and smaller IP."

Joost Van Dreunen, games industry researcher and professor at the New York University Stern School of Business, tells GamesRadar+ he expects "EA will probably consolidate underperforming studios and double down on its sports franchises (which generate 70% of earnings) while potentially spinning off or closing teams working on lower-margin titles.

"I do not expect the new owners to care much for shelved IP other than selling them off to pay down some of the debt. (Personally, I hope the Command & Conquer franchise will get a reboot under someone else's ownership.)"

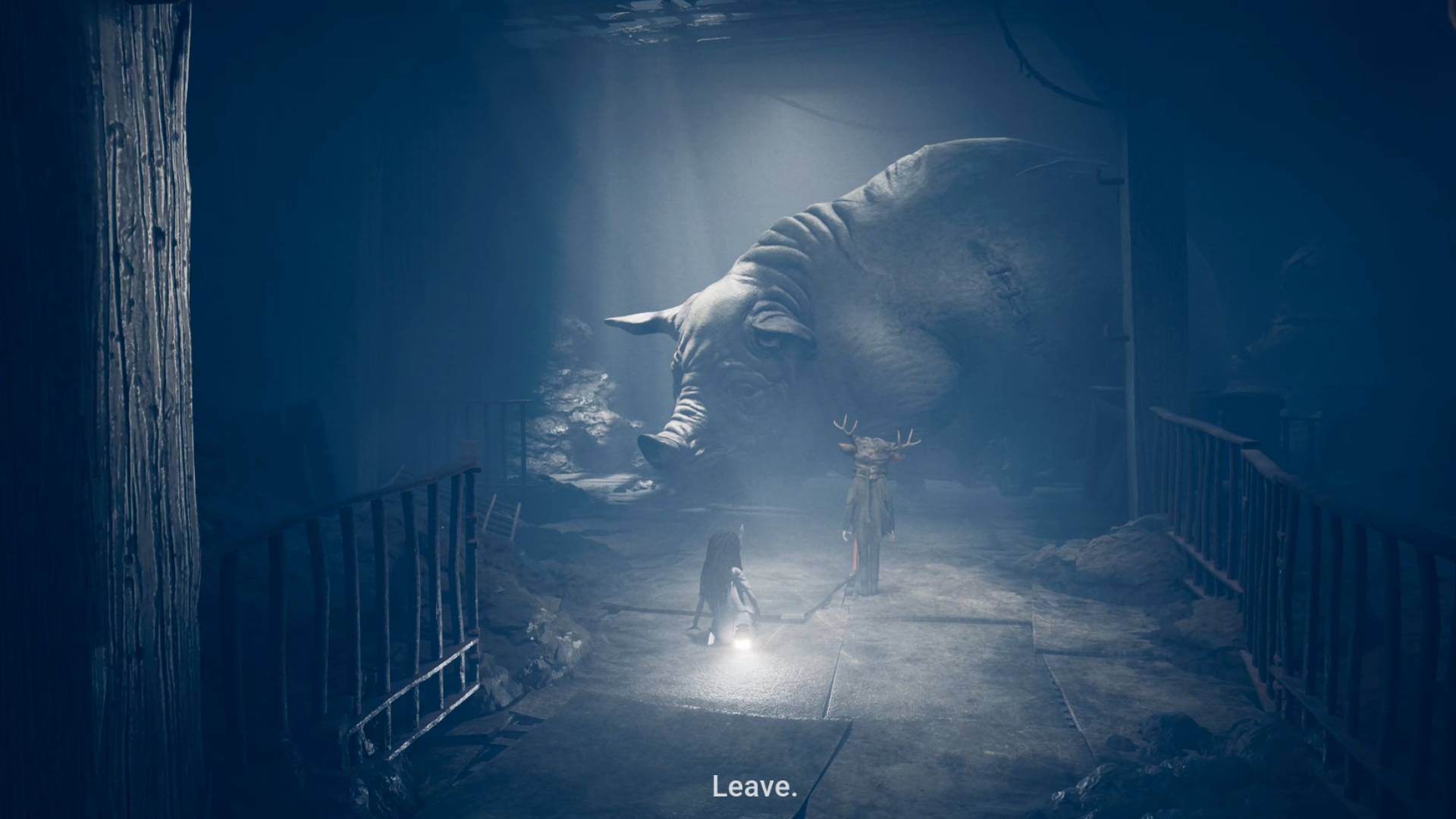

Already, there are fears among fans and former staff that BioWare, already seemingly on EA's naughty list after Dragon Age: The Veilguard underperformed against the company's expectations following protracted development, is near the front of the line quietly forming at the chopping block.

Paying down the $20 billion in debt baked into the deal has put a new elephant in the room. Toto and Cole note that it's not unusual for leveraged buyouts to include large debts. Cole says "it almost always means cost cutting and selling off assets."

Weekly digests, tales from the communities you love, and more

Toto highlights that "there are not too many examples in gaming" for leveraged buyout precedents – and for its sheer size as the largest buyout in history, EA is still an outlier – and agrees this sort of deal is often followed by "radical restructuring of the business, layoffs, new strategy etc."

"I don't see a reason why EA's case should be any different," he says.

More to the point, concerns of pending layoffs at EA "are not only concerns," Toto says, "but at least in my eyes, actual events that we will see unfold going forward. I do not expect to see the new owners take radical action 'next week', but starting in the very near future."

For its part, EA has only assured worried employees, in an internal FAQ made public by the US Securities and Exchange Commission, that there are no "immediate" changes coming to jobs or teams.

In a blog post assessing the deal, Van Dreunen says the $55 billion valuation "doesn't add up" because it drastically overvalues EA based on its annual cash flow.

"Neither EA’s mature business profile nor the current market environment appears to justify such lofty valuations," he writes, pointing to "little growth potential" in EA's dominant sports segment and the inability of games like Apex Legends to achieve "the cultural permanence" of live service rivals like Fortnite.

Van Dreunen points to the benefits of EA freeing itself from shareholder expectations, quarterly metrics, and the rest of the publicly traded baggage. There's deserved pessimism for the future of several EA IPs and internal groups, but the deal may create "some breathing room" for Battlefield 6, he says, as EA's new overseers won't be putting immediate returns under a microscope.

And given Saudi Arabia's track record with aggressive marketing on previous acquisitions (hello, Monopoly Go), Van Dreunen suggests the likes of Battlefield 6 and EA Sports could "actually see increased investment while peripheral operations face pressure."

"Saudi Arabia is seeking to foster engagement, providing EA with at least a temporary reprieve from its strict focus on profitability," he says. "That may yet have its benefits for the publisher and its players," he continues, arguing that privately traded game companies "outperform their publicly traded counterparts." Private companies "can operate as true product businesses, focusing on creative vision and long-term value."

The question is whether this creative vision manifests and aligns with what players hope to see both within, and particularly beyond, EA's live service and sports bubbles.

"At the center sits the irrational financial logic that tells you it’s about power, prestige, and staking Saudi Arabia’s claim in American entertainment," Van Dreunen writes, again targeting Saudi Arabia's Private Investment Fund, a main investor in the deal (and a longtime EA shareholder).

Saudi Arabia's goal here, he theorizes, is to "throw staggering amounts of money at establishing market dominance" in games and to reduce its reliance on oil trade as an economic core.

Cole agrees "the motive is clearly a desire by the Saudis to expand their economy by getting into a high tech industry." For EA, he posits that the enormous deal "is a way to get shareholders an immediate return and also allow EA to function without the demands of answering to public shareholders."

Toto notes that "EA is profitable, scaled, international and sits on some of the biggest IPs in the gaming world - so the LBO might come as a surprise to some." However, he concurs that "I believe that CEO [Andrew] Wilson saw a fundamental challenge for his company coming in the long run and decided to exit at this point in time."

"Please remember that former Activision Blizzard CEO Bobby Kotick remarked exactly this as a critical reason for agreeing to the merger with Microsoft, a deep shift in the way the gaming industry works in the future," Toto adds.

This speaks to a farther-reaching assessment of where games are headed in large part because of the growing presence of live service titans and slow growth in a mature market.

Toto also doesn't expect Saudi investment in games to slow anytime soon. "We live in a free market economy, Saudi Arabia has resources, and the country is not sanctioned," he says.

"In other words, Saudi Arabia can buy into any game company they like in most territories in the world, regardless of what we may think about it. I believe that their plans go beyond the tens of billions they spent so far in Asia and the West and that we will see even more Saudi money flowing into the games market globally over time."

Austin has been a game journalist for 12 years, having freelanced for the likes of PC Gamer, Eurogamer, IGN, Sports Illustrated, and more while finishing his journalism degree. He's been with GamesRadar+ since 2019. They've yet to realize his position is a cover for his career-spanning Destiny column, and he's kept the ruse going with a lot of news and the occasional feature, all while playing as many roguelikes as possible.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.