Anime dating sim about filing your tax return gets delisted from Steam

Tax Heaven 3000 will still launch through itch.io

Tax Heaven 3000 garnered attention earlier this week for the promise of filing your real-life tax returns, but now it's been delisted from Steam.

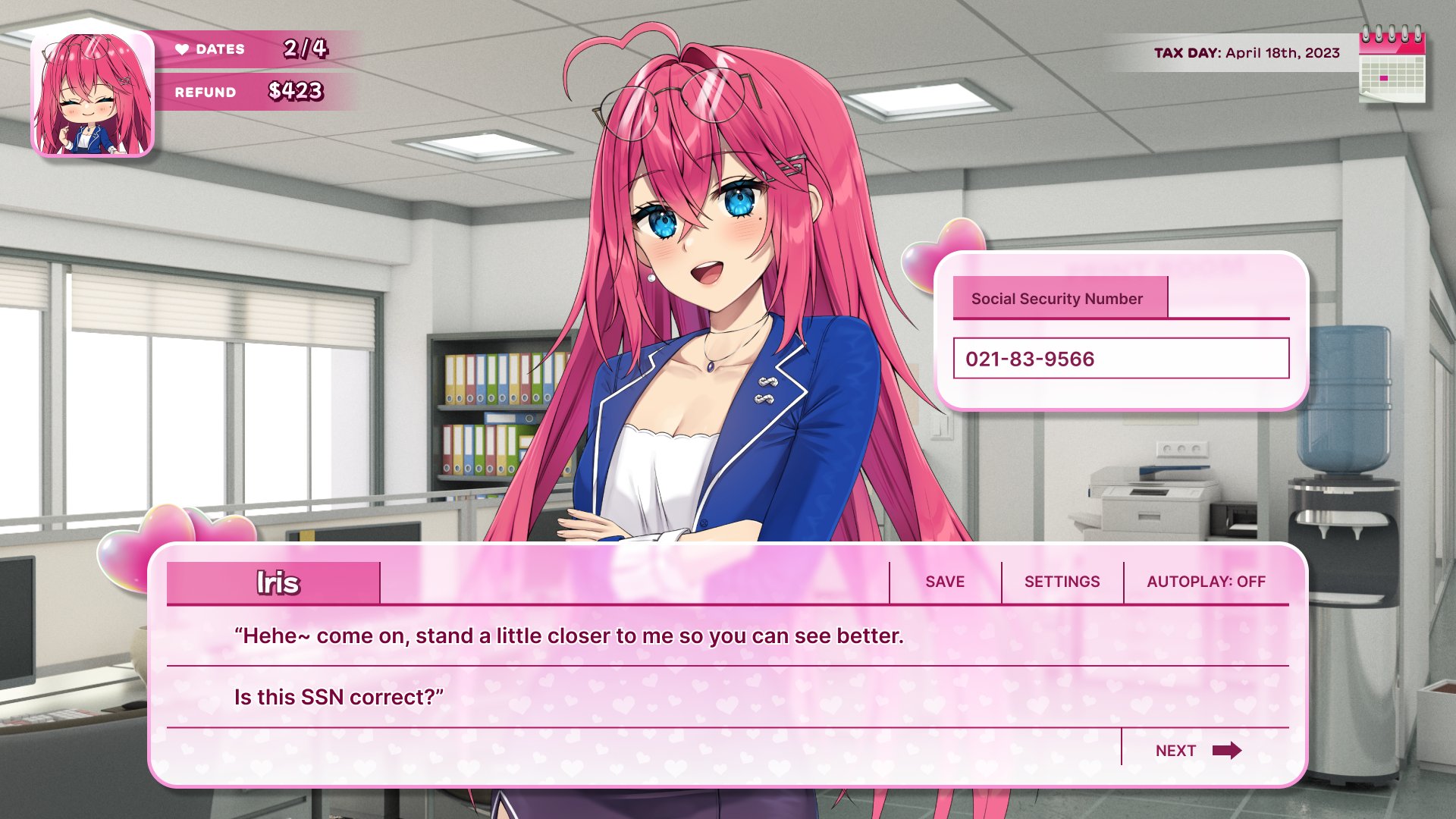

Yesterday on March 22, Tax Heaven 3000 commandeered plenty of attention on Twitter for being a game where an anime girl could help you file your actual tax returns. MSCHF's game pledged a romantic visual novel whereby you befriend a charming woman who's weirdly obsessed with your taxes.

Now though, just a day later, Tax Heaven 3000 is gone from Steam entirely. It's not entirely clear why MSCHF's game has been delisted, by speculation abounds that Valve might've deemed the game to be a scam, and given it the boot from the digital platform entirely.

Lol, looks like Tax Heaven 3000 got removed from Steam for the time being because Steam thinks it's a scam lol. https://t.co/rzNzYFqkNq pic.twitter.com/nuIjMkSjXgMarch 22, 2023

There's also the matter of privacy with personal details - many were perplexed yesterday that the anime woman could ask for your social security number. However, MSCHF co-founder Daniel Greenberg told Kotaku that this isn't something players will have to worry about, because Tax Heaven 3000 doesn't connect to the internet.

Daniel Greenberg, the co-founder of MSCHF, tells me players won't have to worry about Tax Heaven 3000 stealing their data and private info because the game does not connect to the internet.https://t.co/QpY9BOye8IMarch 22, 2023

Still, this could be a factor in why Valve decided to delist the game from Steam. If you're looking forward to Tax Heaven 3000, there's good news to come from all of this, as MSCHF's game will instead launch via Itch.io. Tax Heaven 3000 should be set to launch next week on PC, just in time for the April deadline of filing your personal US Federal tax returns.

Check out our upcoming indie games guide for a look at all the other, slightly more normal, indie games set to launch in the coming weeks and months.

Weekly digests, tales from the communities you love, and more

Hirun Cryer is a freelance reporter and writer with Gamesradar+ based out of U.K. After earning a degree in American History specializing in journalism, cinema, literature, and history, he stepped into the games writing world, with a focus on shooters, indie games, and RPGs, and has since been the recipient of the MCV 30 Under 30 award for 2021. In his spare time he freelances with other outlets around the industry, practices Japanese, and enjoys contemporary manga and anime.